hotel tax calculator illinois

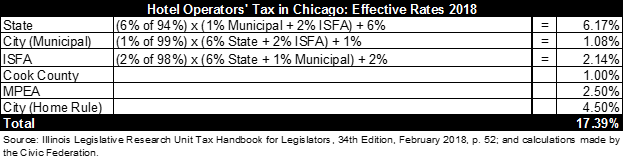

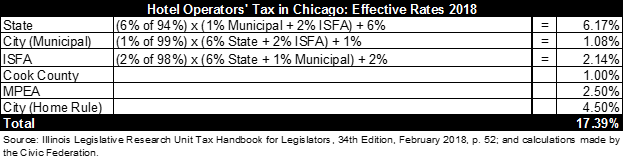

A six-percent state tax for lodging an additional 1 percent Cook County hotel tax and the Metropolitan Pier and Exposition Authority MPEA taxes levied by the city of Chicago and other agencies round out the tax. They are charged a 4 percent room tax.

Name Description MyTax Illinois.

. Call our TDD telecommunications device for the deaf at 1 800 544-5304. Metropolitan Pier and Exposition Authority Hotel Tax. Rhode Island State Sales and Hotel Tax.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. The Illinois IL state sales tax rate is currently 625.

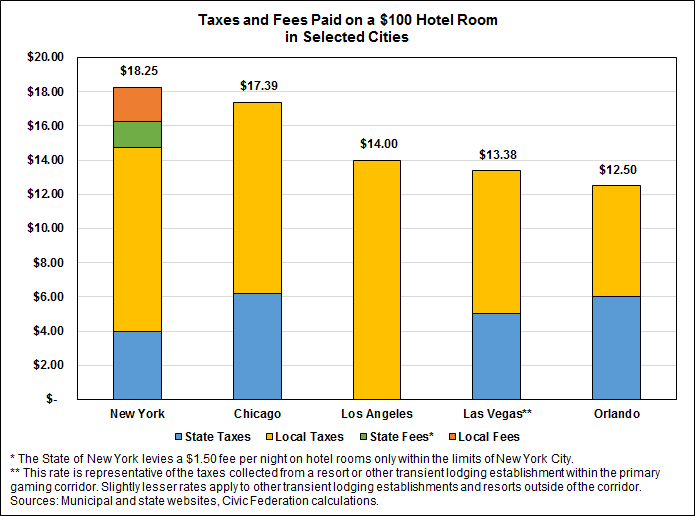

Beer will generally be subject to a rate of 23 cents per gallon while liquor is subject to a rate of 855 per gallon. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room. Each hotel guest in Chicago will pay 1627 in combined fees.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Illinois local counties cities and special taxation districts. Overview of illinois taxes illinois has a flat income tax of 495 which means everyones income in.

Illinois Sports Facilities Hotel Tax. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160 rooms. Illinois Alcohol and Tobacco Tax.

Hotel tax calculator illinois. The Illinois state sales tax rate is currently. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The Vermilion County sales tax rate is. To submit Food and Beverage Tax you will need your state sales tax return ST-1. To submit HotelMotel Tax you will need your Illinois Retailers Sales and Use Tax or Hotel Operators Tax returns for the month.

The City of Chicago levies taxes on both hotel operations and occupancy. The tax is reported on Form RHM-1 Hotel Operators Occupation Tax Return. If imposed the preprinted rate on Form RHM-1 will include this tax.

Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Has impacted many state nexus laws and sales tax collection requirements. 54 rows 3 State levied lodging tax varies. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Call us at 217 782-6045. The state hotel tax rate is 6 percent. You can calculate the rate with the multiply answer by 100.

The City charges a 45 hotel accommodations tax and a 60 additional home share tax on rentals through companies such as Airbnb as well as a 10 hotel operators tax. Hotel Tax Matrix City of Chicago HOTEL ROOM REVENUE Revenue Taxable Description Furnished By Hotels YN Tax Type Comments This matrix addresses only those City of Chicago taxes that are administered by the Chicago Department of Revenue. If filing a tax period prior to April 2011 call 217 785 6606 to obtain the correct form.

Call us at 217 782-6045. The tax also applies to lodging at bed and breakfasts condominiums apartments and houses rented for less than 30 consecutive days. Only In Your State.

The original 40 home share tax was implemented in 2016 to fund supportive services related to housing for the. Depending on local municipalities the total tax rate can be as high as 11. Lodging is subject to a state sales tax plus each county levies a hotel or lodging tax.

The cigarette excise tax in Illinois is 298 per pack of 20. Other local-level tax rates in the state of Illinois include home rule non-home rule water commission mass transit park district business district county public safety public facilities or transportation and county school facility tax. Illinois has a 625 statewide sales tax rate but also has 495 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1904 on.

Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. The matrix does not address the City of Chicago taxes that are enforced by the Illinois Department of Revenue. State hotel occupancy tax applies to charges of 15 or more per day for sleeping accommodations meeting rooms and banquet rooms in a hotel or motel.

The due date is the same as provided for in the Hotel Operators Occupation Tax. 30 days or less. The 2018 United States Supreme Court decision in South Dakota v.

The new form mirrors the 7520 tax return but the Tax and the Surcharge should be paid and reported separately beginning with the December 2018 payment due 11519. Except as noted on their respective pages the preprinted rate on the return will include any locally imposed taxes. Additionally to receive credit for permanent residents you will need a list of permanent residents and their receipts.

For more information see Hotel Operators Occupation Taxes Tax Information. To review the rules in. But instead of increasing taxes on local residents property taxes for example state and local.

A monthly return is due on or before the last day of the month following the month for which the return is filed. The state collects the state sales tax and each county collects its own local hotel tax. Write us at Illinois Department of Revenue Miscellaneous Taxes Division PO.

Hotel tax calculator illinois. 4 Specific sales tax levied on accommodations. Call our TDD telecommunications device for the deaf at 1 800 544-5304.

The following local taxes which the department collects may be imposed. Hotel Operators Occupation Tax Return R-0513 NOTE. Box 19477 Springfield IL 62794-9477.

The Hotel Accommodations Tax remains 45. State has no general sales tax. Illinois applies per-gallon alcohol excise taxes based on the alcohol content of the beverage being sold.

The Vermilion County sales tax rate is. As a reminder the Surcharge rate is 6 as of 12118.

How Do State And Local Sales Taxes Work Tax Policy Center

Illinois Sales Tax Guide And Calculator 2022 Taxjar

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Trip Cost Calculator Fleet Management

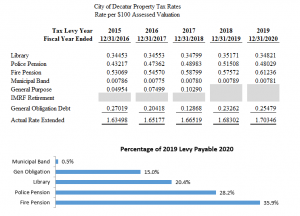

Property Taxes Other Tax Information Yorkville Il Official Website

2020 Illinois Trade In Sales Tax Law Change

Property Tax City Of Decatur Il

Here S How Much Money You Take Home From A 75 000 Salary

Hotel Operators Occupation Tax Excise Utilities Taxes

How To Charge Your Customers The Correct Sales Tax Rates

Law Firm Website Design Paperstreet Law Firm Website Law Firm Website Design Law Firm

Illinois Sales Tax Quick Reference Guide Avalara

Property Tax Village Of Carol Stream Il

Property Tax City Of Decatur Il

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation