an example of open-end credit is a(n) ____

Is a sort of credit that must be paid back in full by the end of the. An amount of time during which a loan can be repaid without interest.

E installment loan for purchasing a major appliance.

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

. B the mortgage loan from a savings and loan institution. Pledged to a company as security for a loan repayment. However by establishing an open-end credit account with a limit of at least 500 the consumer would save the additional 159 annually in premiums assuming no transaction costs to opening the account would only need to exercise the credit option in the event of a loss and could extend the repayment over three years or more.

With open-end loans borrowers can spend money up to a. A ____ of credit is an example of an open-end credit. Installment loan from a furniture store.

Tanya received a 1000 loan from the bank for a vacation. View the full answer. Week 2 Quiz 1.

Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. The mortgage loan from a savings and loan institution.

With some forms of open-end credit theres no end date. View Test Prep - Week 2 Quiz from BUS ACCOUNTING at California State University Monterey Bay. An example of open-end credit is mortgage loans as there are specific open end mortgage loans available so correct option will be C mortgage loans Automobile loans and revolving check credit are closed ended loans.

Open-end credit is A. Both the interest and service charge are finance charges. A good example of an open-end credit is A.

Lets assume a lender will loan 75 of your homes current market value. D installment loan from a furniture store. C automobile loan from a credit union.

A home equity line of credit is an example of open-end credit. In this case Peter borrowed 225 but paid an interest of 20 and 3 as service charge. The use of a bank credit card to make a purchase.

Credit cards home equity loans personal lines of credit and bank account overdraft protection are all examples. B the mortgage loan from a savings and loan institution. AAn automobile loan BA department store credit card CAn installment loan for purchasing furniture.

Any sort of loan that allows you to make several withdrawals and repayments is known as open-end credit. Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods. Periodic payments are made until the loan is paid.

Example problem for how much you can borrow using a Home Equity Loan. A loan given for a short period of time that is not dependent on credit history. Different Ways to Calculate 1.

An example of conventiona. Which of the following is an example of open-end credit. But in this case it allows the borrower to increase the amount of the loan at a.

D installment loan from a furniture store. A good example of an open-end credit is A the use of a bank credit card to make a purchase. Automobile loan from a credit union.

Which of the following is an example. With a closed-end loan you borrow a specific amount of money. True The effective annual rate of interest on a loan based on a specific calculation as set forth by law.

Installment loan for purchasing a major appliance. Open-end loans can also take the form of credit cards or home equity lines of credit. C automobile loan from a credit union.

In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. Essentially if the card issuer remains in business and the account remains in good standing your open-end credit could be.

Finance questions and answers. Open-end credit and Closed-end credit. Examples of an Open-End Loan.

150000 x 075 112500. The bank is using. For example with a credit card you can repay your balance and reborrow as long as the card issuer allows you to continue using the credit product.

A good example of an open-end credit is A the use of a bank credit card to make a purchase. The issuing bank. E installment loan for purchasing a major appliance.

Open End Credit This is a type of credit loan paid on installments in which the total amount borrowed may change over time and is fixed. A common type of open-end loan is a line of credit. Subtract Balance due on Mortgage in this example 75000 is left 112500 - 75000 37500.

To better understand open-end credit it helps to know what closed-end credit means. Approximate market value of your home.

English File 3e Pre Int Sb Answer Key

English File 3e Pre Int Sb Answer Key

Csci Exam 2 Flashcards Quizlet

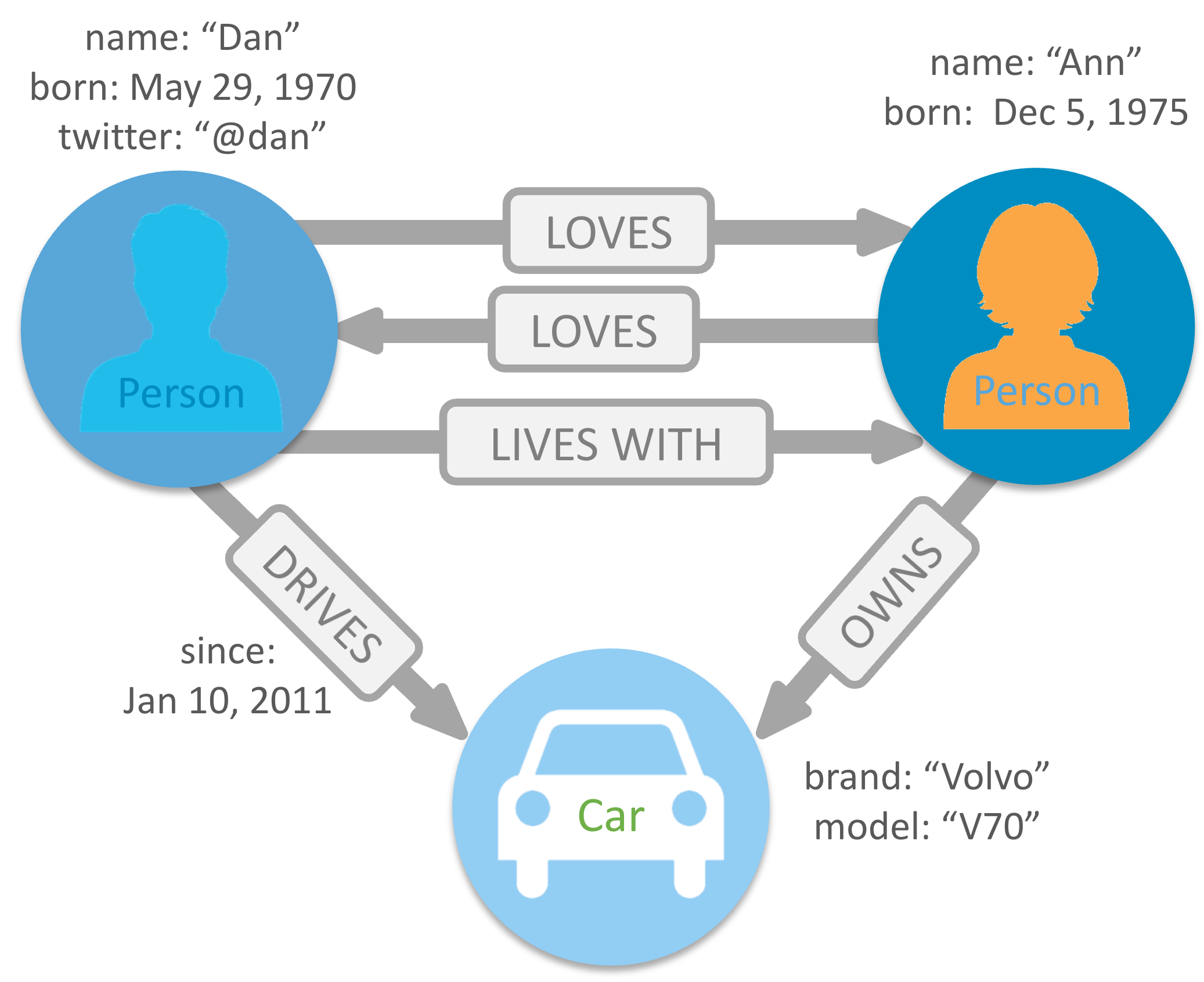

Concepts Of Database Design Final Flashcards Quizlet

Types Of Accounts Classification Of Accounting Personal Impersonal

Irrelevant Insights Make Worldviews Ring True Scientific Reports

English File 3e Pre Int Sb Answer Key

Wharton Coursera Entrepreneurship Quiz Pdf Module 1 Introduction To Entrepreneurship Quiz Quiz 10 Questions Question 1 1 Point 1 Question Course Hero

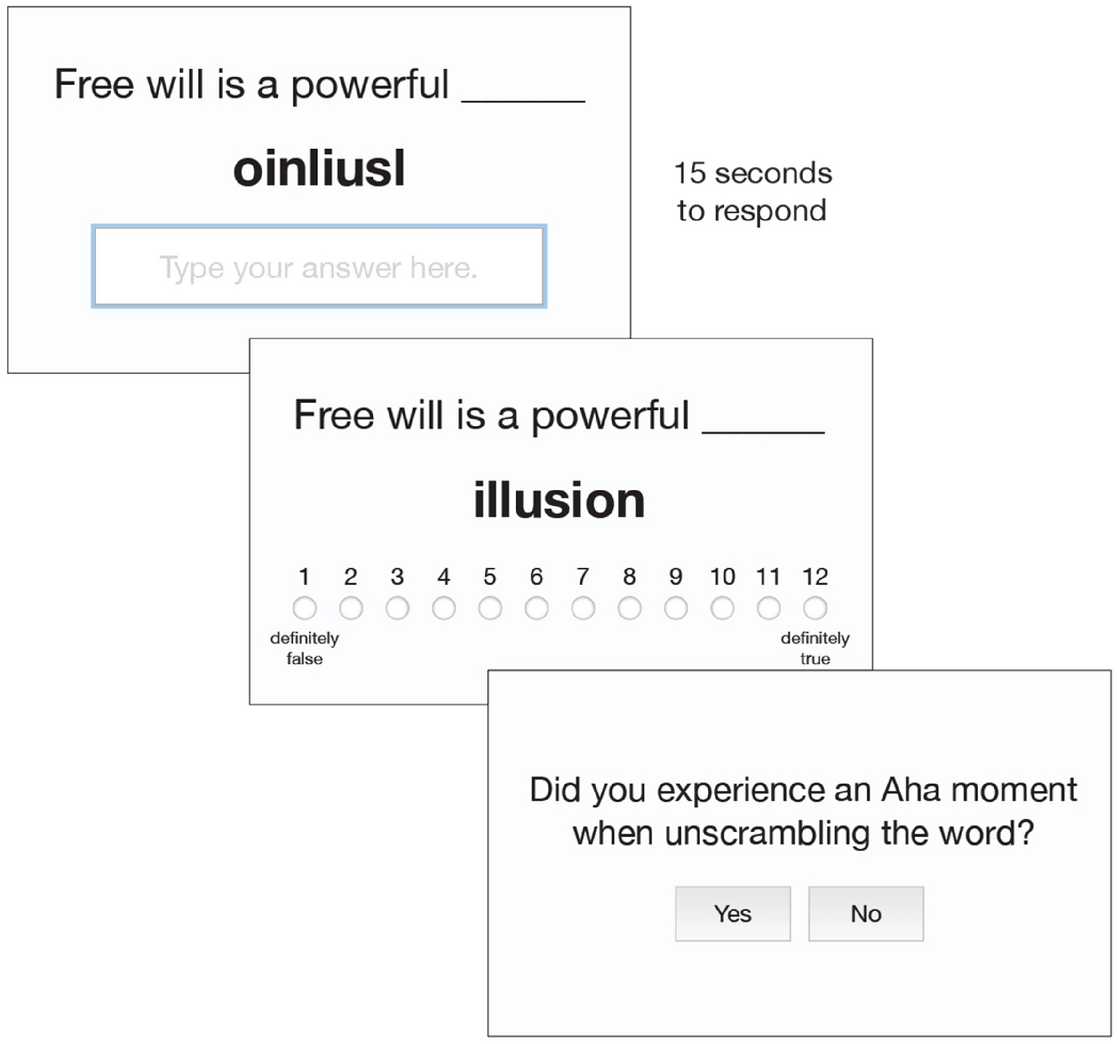

Fill In The Blank Questions Blackboard Help

What Is A Graph Database Developer Guides

Fill In The Blank Questions Blackboard Help

Stress Testing Of Consumer Credit Default Probabilities Using Panel Data Matlab Simulink Example

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)